Business Process AutomationLearn more

Operational Excellence Now Defines Value Creation in Private Equity

Leading private equity firms know that leverage alone is not enough to create value post-acquisition. With global exits at a 10-year low, it has rarely been harder to sell a portfolio company. Rising pressure on portfolio managers, higher acquisition costs, and tougher exit conditions demand more innovative ways to achieve stronger valuations within the holding period. The solution: driving operational excellence through automation.

Pressures on PE firms

In today’s uncertain market, private equity directors and operating partners face mounting pressure to deliver results faster and at higher exit valuations. Relying on rising multiples and revenue gains to generate returns no longer works when rising interest rates serve as ballast for asset multiples.

At the same time, higher interest rates and reduced liquidity make exits harder to achieve. Coupled with longer holding periods, this has created a sluggish exit environment where only companies generating strong, consistent cash flow stand out as attractive to buyers.

Adding to the challenge, rapid advances in artificial intelligence are reshaping competition. Portfolio companies that harness AI effectively are positioned to exit faster and at higher valuations, while those that lag risk being left behind like it happened with internet adoption back in the 90’s.

Leverage Is Not Enough

Relying solely on financial engineering—such as debt leverage or multiple arbitrage—is no longer enough under today’s conditions. Operational excellence is now the true differentiator for superior returns and value creation in private equity has already shifted away from financial leverage.

Firms that embed efficiency and scalability into their portfolio companies consistently outperform peers. And the industry is moving in this direction: PwC’s Private Equity Trend Report 2024 found that 30% of respondents cited operational improvements as the single most important driver of performance.

Common operational challenges in portfolio companies

Many portfolio companies enter acquisitions with operational gaps that hinder growth and scalability. These challenges consume management’s time, slow execution, and block the path to higher valuations. What are they?

- Legacy processes: Many mid-market companies still rely on spreadsheets, emails, and ad-hoc workflows. While this might work for a small founder-led business, it becomes unscalable post-acquisition when growth accelerates or add-ons are integrated.

- Manual work breakdowns: As businesses grow and stakeholders multiply, manual processes begin to fail and old ways of working can’t keep up with new demands.

- Fragmented data: Critical information is often scattered across disparate systems with no single source of truth. This leads to inconsistencies that make decision-making and reporting difficult.

- Communication overload: Teams are overwhelmed with endless email chains and manual updates just to keep operations running. Simple changes can trigger lengthy threads that drag on productivity.

- Firefighting vs. scaling: Executives spend too much time putting out fires instead of focusing on strategic initiatives that drive growth.

- Lack of visibility: Without proper systems, leadership has little insight into performance. If efficiency and productivity can’t be measured, they can’t be improved.

- Cultural inertia: A fixed mindset of “we’ve always done it this way,” combined with reliance on overstretched IT teams, often blocks innovation. Outdated technology and inaction become major barriers to progress.

Turning operational challenges into opportunities

The operational hurdles many portfolio companies face—with the right approach—can be turned into levers for value creation.

Opportunity 1: Operational Excellence as a Differentiator

Financial restructuring and multiple arbitrage are common and increasingly commoditized. True alpha now comes from driving operational excellence. Firms must actively improve how portfolio companies operate by embedding automation and AI, creating organizations that are scalable, efficient, and resilient.

Those that master operational improvements consistently outperform peers in EBITDA growth and exit multiples. Efficient operations become a competitive advantage throughout both the holding period and the exit process.

The market is rewarding these improvements. Amid today’s AI hype, companies that not only invest in automation but also demonstrate measurable ROI are perceived as more valuable. Buyers pay a premium for proven AI-driven results.

Opportunity 2: Investing in inefficiency: Value creation strategy

Companies running on spreadsheets, manual workflows, or chaotic back-office processes are often undervalued. For an operationally savvy PE firm, this inefficiency represents an opportunity to buy low and improve. By applying a structured automation framework, bottlenecks can be identified, quick wins captured, and lessons standardized into a portfolio-wide playbook.

Starting with one company, you can establish better visibility through metrics and dashboards at the managerial and executive level. Over time, the lessons and improvements can be rolled out portfolio-wide, multiplying the value creation across all investments. This repeatability turns operational improvement into a core part of the investment strategy.

Opportunity 3: The automation & AI as a lever

Modern, automated, AI-enabled companies are perceived as more resilient and future-proof—and buyers will pay a premium for them. Especially when it is backed by hard numbers on how these automations directly boost EBITDA and IRR. With the right methodology you can precisely calculate revenue making sure you focus on solutions that increase margins.

The benefits go deeper:

- Driving growth by scaling faster and freeing executives for strategy.

- Freeing hours of work by removing manual, error-prone tasks.

- Improving efficiency by streamlining workflows and reducing bottlenecks.

- Delivering tangible financial gains through better margins, faster revenue cycles, and cost savings.

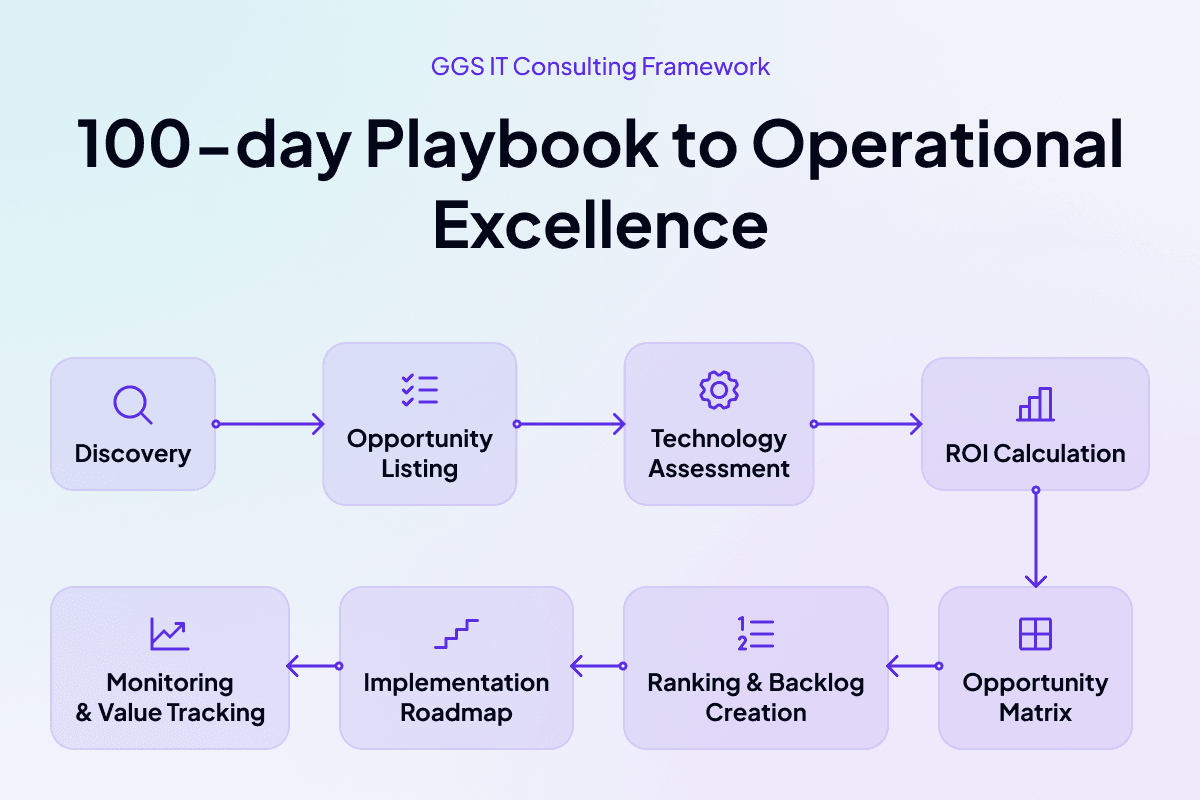

The 100-Day Playbook: GGS Approach

At GGS, we’ve redefined the 100-day playbook for private equity with a focus on operational excellence. Our approach starts with discovery workshops across departments to map workflows, uncover inefficiencies, and baseline performance. Our team scrutinizes processes company-wide and within each department.

We then identify high-impact processes and evaluate the existing tech stack to spot overlaps, gaps, and automation potential. Each process and inefficiency is assessed against FTE allocation, error rates, cycle times, cost of inefficiency, and lost opportunity perspective.

This assessment helps us calculate ROI and create a matrix of opportunities to allocate resources to the highest value-creation levers. That becomes the foundation for building a backlog supported by a phased implementation roadmap. Early phases deliver pilots and visible proof points, followed by scaling high-value systems. Together with leadership, we prioritize quick wins alongside long-term bets.

Once in motion, culture shifts and automation becomes so embedded in the organization that employees begin contributing new ideas themselves and can't image working without automation as a co-pilot. New initiatives are continuously monitored for adoption and ROI. Quarterly reviews track efficiency, cost, and revenue impact, feeding new insights back into the plan. The result is a repeatable framework that compounds value creation throughout the holding period.

High-impact areas for automation

Not everything should be automated at once – but certain core processes in mid-market companies offer especially high ROI when streamlined. Here’s what you can and should automate:

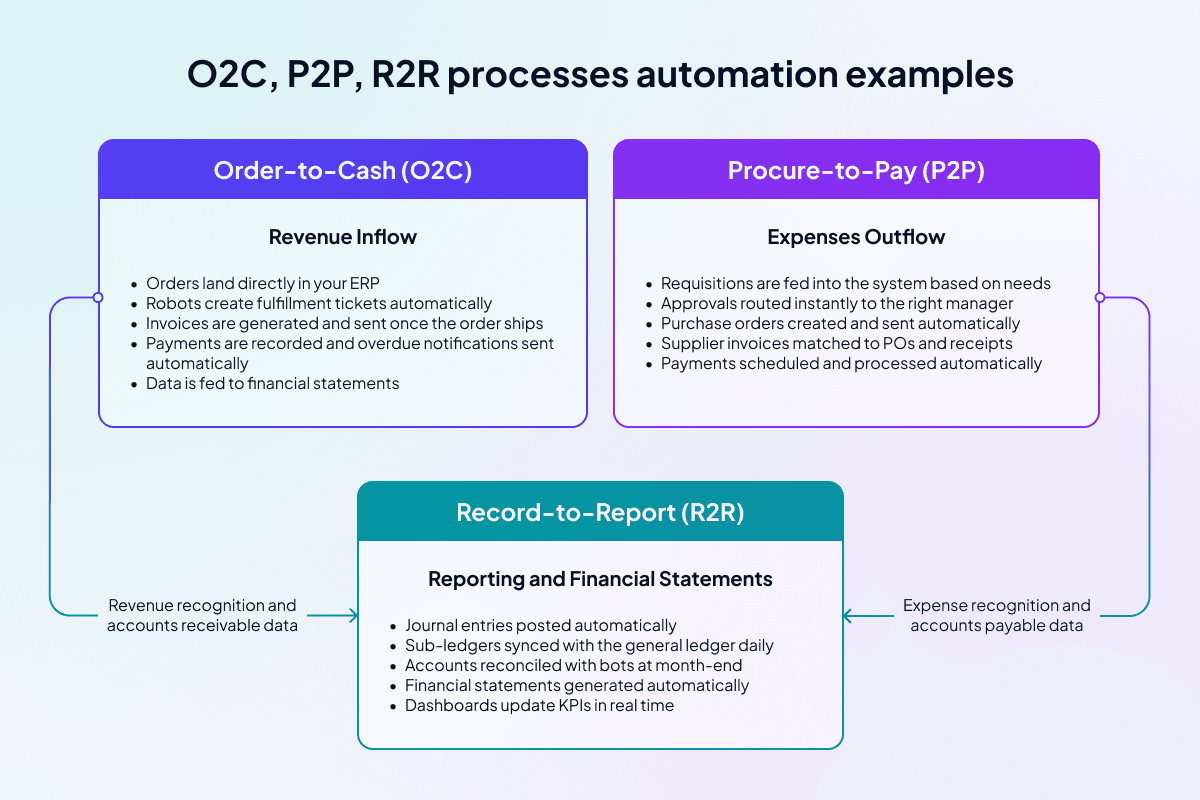

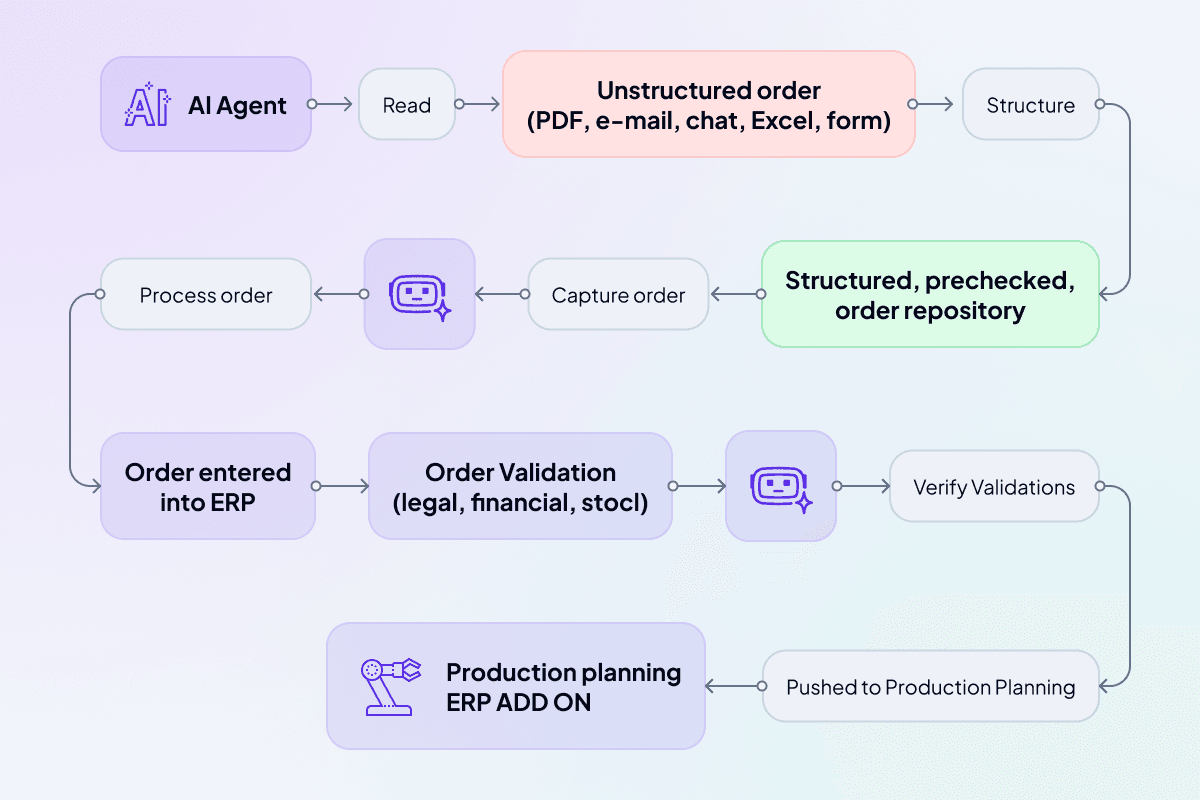

- Order-to-Cash (O2C): Automating the O2C cycle (from customer order and fulfillment to invoicing and payment collection) speeds up revenue recognition and reduces errors or delays.

- Purchase-to-Pay (P2P): Streamlining P2P (procurement through vendor payment) cuts costs by improving purchasing efficiency, reducing maverick spend, and avoiding late payment fees.

- Record-to-Report (R2R): Automating financial consolidation and reporting ensures timely, accurate financial statements and frees up the finance team for analysis rather than data gathering.

- Order fulfillment and shipping: Automating order scheduling, tracking, and logistics improves on-time delivery rates and customer satisfaction while reducing manual coordination.

- Warranty and claims processing: Implementing systems for handling warranties, returns, and claims reduces turnaround time and labor effort, improving customer experience and reducing cost leakages.

- Sales and operations planning: Automation tools can integrate sales forecasts with production planning, ensuring alignment between demand and supply and optimizing inventory levels.

- Production planning: Streamlined, system-driven production scheduling optimizes equipment use and labor allocation, increasing throughput and reducing downtime.

- Resource management: Automating resource and workforce management (e.g. scheduling, time tracking, capacity planning) leads to better utilization and lowers overtime or contractor costs.

- Supply chain operations: From procurement to inventory management to distribution, automation and AI can significantly cut lead times, reduce stockouts or overstock, and adapt faster to supply disruptions.

- Sales management: CRM automation, lead routing, and sales analytics can help the sales team focus on closing deals and identifying opportunities, driving top-line growth.

- Document matching and data entry: Automating routine tasks like invoice matching, data entry, and report generation eliminates human error and frees staff for higher-value work.

Success stories in operational excellence

These real-world examples illustrate how a structured focus on operational improvement and automation delivers tangible results for companies (and their PE owners).

Agnella: 35+ processes optimized, 20% productivity gain

GGS supported Agnella in optimizing and automating more than 35 processes. The project delivered a 20% direct labor reduction (maintaining output with fewer employees), unified 12 production processes, and increased labor efficiency by 35%. Additional outcomes included $500K annual licensing cost savings, reduced administrative errors, improved product quality, and standardized documentation.

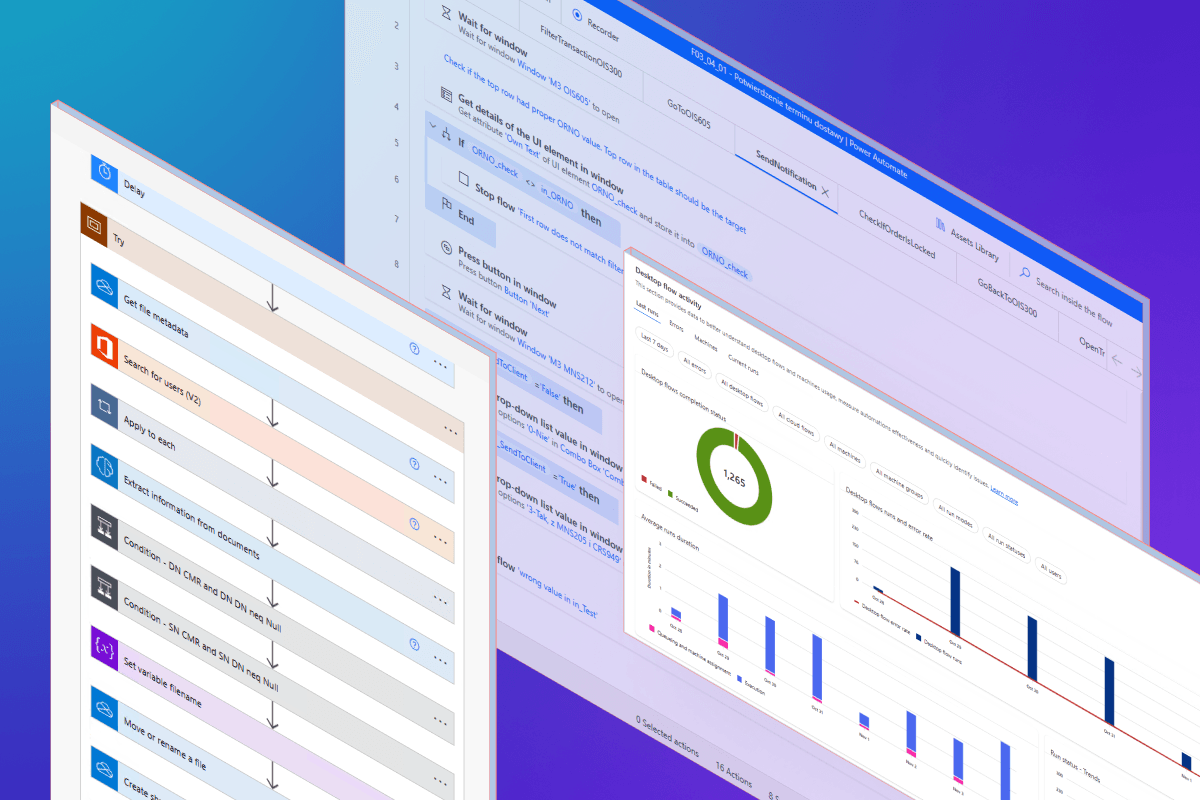

Flokk: 40+ automations across six European markets

For Flokk, a European furniture manufacturer, GGS implemented more than 40 automations operating 24/7 across six European markets. Results included CRM optimization (from 3 days to 10 minutes), automated invoice and transport document matching, 60% faster receivables collection, compliance checks reduced to 15 minutes, and a stable automation environment with low maintenance costs.

General Mills: 120 tools connected into one platform

At General Mills, GGS developed mechanisms for data gathering, created a series of business intelligence reports, and built a consolidation app that integrated 120 disconnected tools. The focus was on enabling data-driven decision-making and building AI readiness to future-proof operations. Reducing the number of applications improved employee satisfaction while decreasing compliance and legal risks.

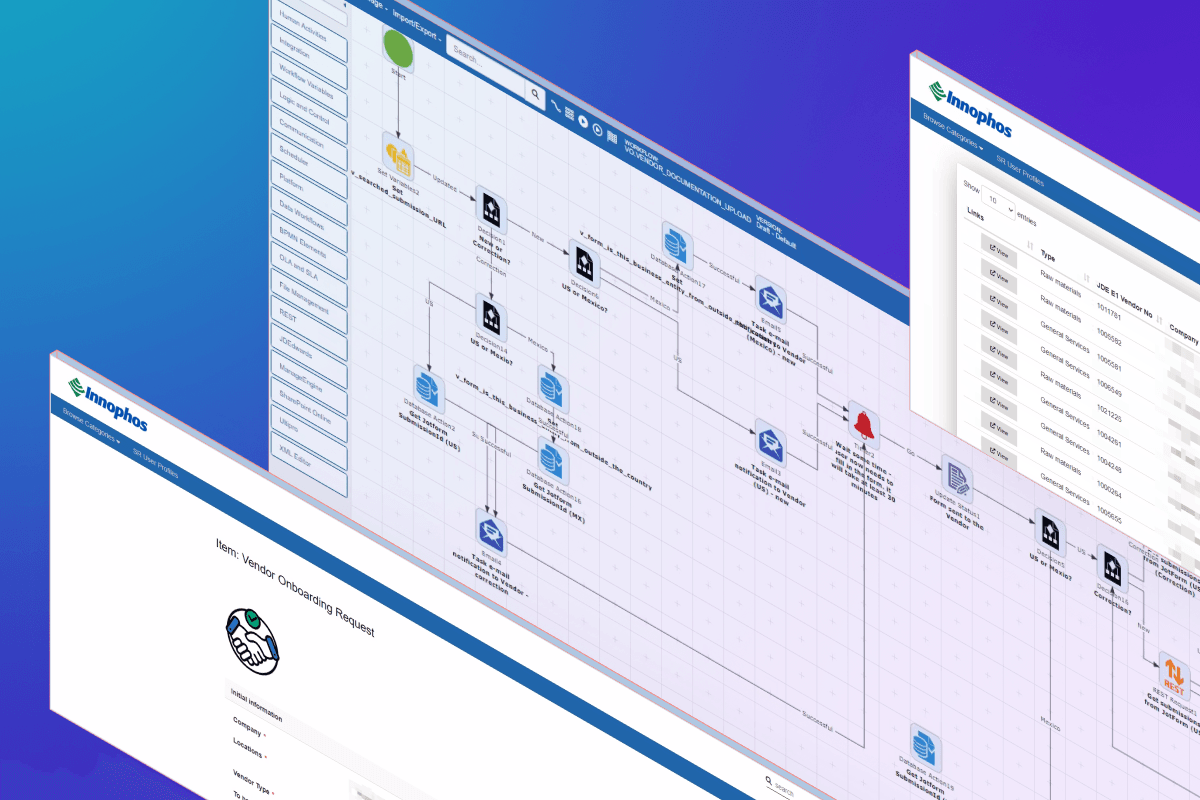

Automating regulatory-heavy processes

For a PE-owned health and nutrition ingredients producer operating in a heavily regulated market, GGS streamlined a scattered vendor onboarding process. Previously, onboarding was handled entirely by email, with each department working in silos under its own rules and exceptions. Contracts and agreements were often lost or duplicated. We built a centralized, automated workflow that connected all departments in a single process integrated with the ERP. As a result, the onboarding cycle was reduced from 168 days to just 15.

Westwing — Streamlining operations with an automation hub

At Westwing, GGS analyzed, mapped, and automated core business processes. Based on this assessment, we introduced Robotic Process Automation (RPA) tools that delivered the greatest efficiency gains. The automation resulted in:

- 100% process accuracy

- 99.9% process reliability

- Optimized pricing timing

- Reduction of 2 FTE equivalents

- Lower workload in operational departments

- Strengthened internal tech competencies

Operational excellence for higher returns

The examples and strategies above illustrate that achieving operational excellence isn’t about one-off fixes or minor tweaks—it requires making efficiency, scalability, and automation core to your value creation plan.

When operational efficiency is baked into the 100-day plan and beyond, portfolio companies reach their targets faster and with stronger financials. This can lead to higher exit valuations and shorter holding periods—meaning a PE firm can cycle capital more quickly and take on more deals with greater overall returns.

Firms that prioritize modernizing operations will have a competitive edge in both acquiring companies (by knowing how to unlock value others miss) and exiting them (by offering buyers well-run, future-ready businesses).

You don’t have to navigate this journey alone. Whether it’s developing a 100-day operational improvement playbook or executing an AI-driven automation strategy, our team is ready to help. If you’d like to discuss a tailored operational excellence game plan for your portfolio, let’s talk—a smarter, faster path to value creation is within reach.

You can drop a message here or send an email at bartek.podolski@ggsitc.com.