The Hidden ROI of Automation: Which Portco Processes and Workflows to Fix First

Financial engineering can get you only so far. In today’s market, where multiples are compressed and competition is fierce, the real differentiator in value creation is operational excellence.

It’s easier said than done. Everyone talks about it. Everyone knows it’s important. Yet in most portfolio companies, “operational excellence” ends up as a 100-page report for the first 100 days delivered by an external consultant. You get a diagnosis of what’s wrong—but not the tools or capabilities to fix it and the portfolio company is left with little support to execute.

How do you actually achieve operational excellence without disrupting day-to-day operations?

In this article, we’ll share practical tips and best practices for turning strategy into action. You’ll learn where to look for improvement opportunities and how to identify quick wins—based on real projects we’ve implemented across multiple portfolio companies.

Start with the right questions

Before you automate or optimize anything, start by understanding how information flows through the business. Information collected through a thorough assessment will serve as the backbone of operational excellence.

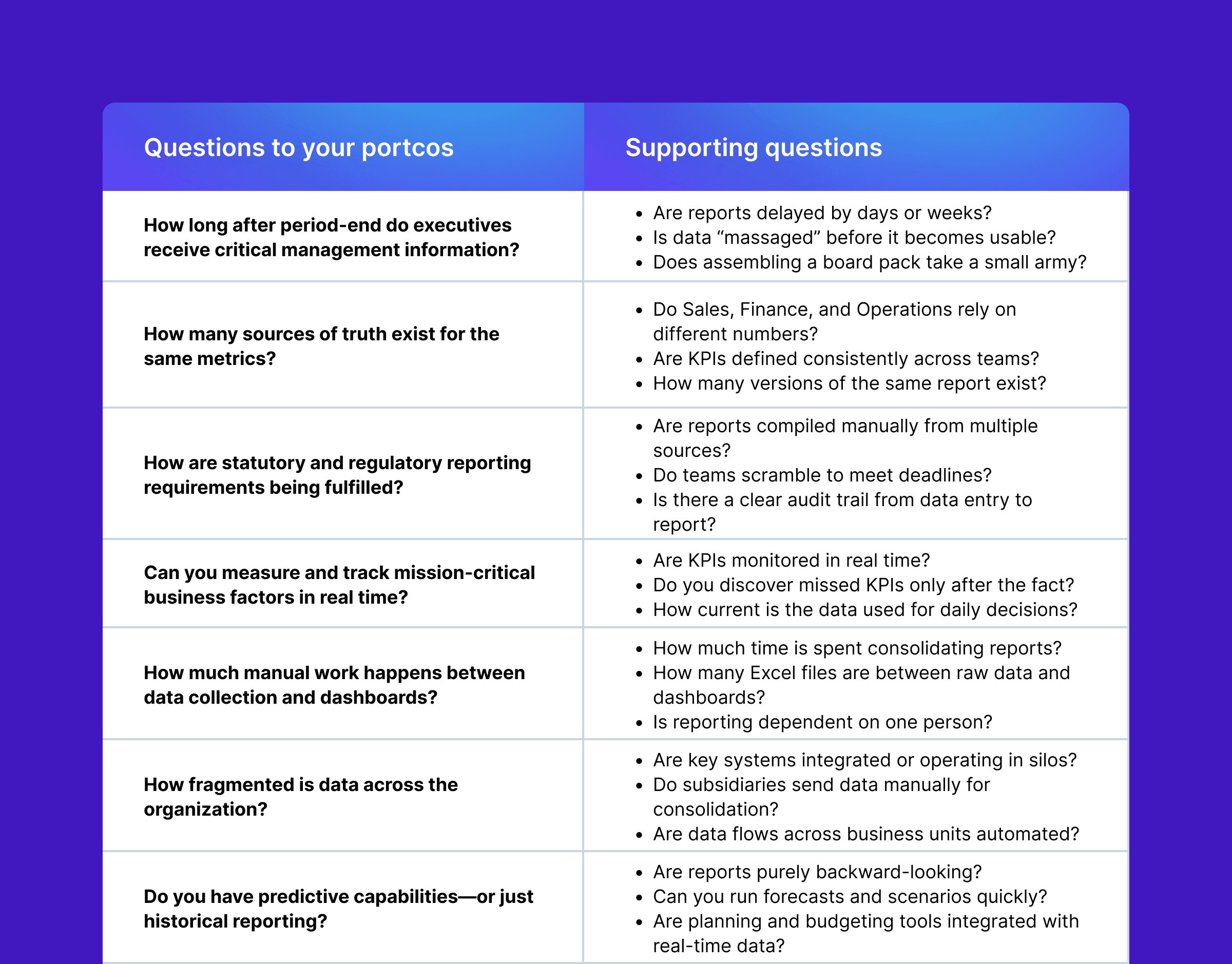

Here are 7 key questions to uncover improvement opportunities:

1. How long after period-end do executives receive critical management information?

Significant delays in receiving management reports—longer than five days for monthly reporting—are a red flag. Weekly and daily dashboards should be updated in real time. It’s not only about frequency: if data is “massaged” or manually adjusted before it becomes meaningful, it’s time to rethink reporting. Board packs also shouldn’t require days or a full team to assemble.

Supporting questions:

- Are reports delayed by days or weeks?

- Is data “massaged” before it becomes usable?

- Does assembling a board pack take a small army?

2. How many sources of truth exist for the same metrics?

When different departments show different numbers for the same KPI, the organization loses trust in its data. Sales, Finance, and Operations should rely on a single, consistent source of truth. Conflicting metrics often indicate fragmented systems and manual reconciliations.

Supporting questions:

- Do Sales, Finance, and Operations rely on different numbers?

- Are KPIs defined consistently across teams?

- How many versions of the same report exist?

3. How are statutory and regulatory reporting requirements being fulfilled?

If meeting regulatory or audit deadlines requires last-minute effort and manual compilation, the reporting process is too fragile and error-prone. Lack of traceability from source data to final submission is inefficient, and more importantly, it’s a compliance risk.

Supporting questions:

- Are reports compiled manually from multiple sources?

- Do teams scramble at quarter- or year-end to meet deadlines?

- Is there a clear audit trail from data entry to filed report?

4. Can you measure and track mission-critical business factors in real time?

Decisions made on outdated data are risky. Key performance indicators and business drivers should be tracked continuously, not retrospectively. When management can’t see the current state of operations, they can’t act fast enough.

Supporting questions:

- Are KPIs monitored in real time?

- Do teams discover missed targets only after the fact?

- How current is the data used for daily decision-making?

5. How much manual work happens between data collection and dashboards?

Every time data leaves a system and lands in Excel, the risk of error multiplies. If performance reports depend on complex spreadsheets or one key person who “knows how it works,” you have a bottleneck. Automation should handle consolidation, not people.

Supporting questions:

- How much time is spent manually consolidating reports?

- How many Excel files sit between raw data and dashboards?

- Is reporting dependent on one person’s knowledge?

6. How fragmented is data across the organization?

When core systems like ERP, CRM, and operations tools don’t communicate, management loses visibility and control. Disconnected subsidiaries or divisions that send data manually for consolidation create latency and inconsistency across the group. Lastly, it leads to hundreds of hours wasted on that manual data transfer.

Supporting questions:

- Are key systems integrated or operating in silos?

- Do subsidiaries send data manually for consolidation?

- How automated are data flows across business units?

7. Do you have predictive capabilities—or just historical reporting?

Reporting should not only tell what happened but also what’s likely to happen next. If forecasting, budgeting, and scenario modeling are done offline in Excel, you will be missing opportunities and reactive decisions will hinder strategic growth.

Supporting questions:

- Are reports purely backward-looking?

- Can you run forecasts and scenarios quickly?

- Are planning and budgeting tools integrated with real-time data?

Red flags to watch for:

- 🔻 Monthly reporting is a “fire drill.”

- 🔻 Executives ask, “Which number is correct?”

- 🔻 Reports are distributed via email, with multiple versions floating around.

- 🔻 The company keeps hiring analysts just to produce reports.

- 🔻 Phrases like “We can’t measure that” or “We’ll get back to you” appear too often.

- 🔻 If this sounds familiar, you have an management information system problem—and therefore, a value creation opportunity.

Look for automation in the right places

Once you’ve assessed how information flows, the next step is to identify where automation can unlock efficiency and scale. This is where you can free your team from repetitive, low-value tasks so they can focus on decisions that drive growth.

Here are seven key areas to assess for automation potential:

1. Review of the organization structure

Organizational chart is often the first clue. When you see large administrative teams performing similar repetitive work—data entry, reconciliations, reporting—there’s almost always potential for automation. Processes that follow predictable rules and consume significant human time are natural starting points.

🔻 Red flag: A large group of people doing more or less a similar task.

2. Document-heavy processes

Quality management, HR, production control, and compliance functions often rely on manual document handling, signatures, and version control. These activities are rule-based and repetitive, making them ideal candidates for automation. Streamlining document flows improves traceability, reduces errors, and shortens approval cycles.

🔻 Red flag: High volumes of internal or external documentation being processed manually.

3. Work happening outside the ERP system

Many companies run critical processes on standalone tools or homegrown systems that don’t communicate with one another. This creates blind spots and forces employees to duplicate data entry. Integrating systems and automating workflows restores visibility and eliminates redundant effort.

🔻 Red flag: Multiple systems performing similar functions without data integration.

See what you can build on top of your Oracle’s ERP.

4. Overreliance on Excel

Spreadsheets often become a patch for missing systems—but at scale, they slow the business down. When forecasting, planning, or pricing depends on manual Excel files, it signals a lack of process automation. Low-code platforms can replicate spreadsheet logic in a structured, controlled environment.

🔻 Red flag: Planning, forecasting, or reporting driven by spreadsheets.

5. Time spent on routine communication and tasks

Customer service, logistics, and sales teams often spend hours responding to repetitive questions—stock checks, delivery updates, order confirmations. These interactions can be automated through integrated systems, chatbots, or workflow triggers, freeing teams to focus on higher-value activities.

🔻 Red flag: Significant time spent answering routine internal or customer queries.

6. Regulatory and compliance processes

Frequent reporting cycles, audit preparation, and certification renewals are perfect automation opportunities. These processes require precision and traceability, which automation ensures while reducing manual effort and compliance risk.

🔻 Red flag: Manual preparation of regulatory or audit documentation takes weeks to prepare.

7. Handling of unstructured data

Emails, contracts, and customer messages often contain valuable data locked in unstructured formats. Modern AI tools can extract, classify, and route this information automatically, turning time-consuming manual review into a seamless digital process.

🔻 Red flag: Large volumes of emails or documents processed manually.

General patterns to recognize:

- If a task doesn’t involve customers or strategic decisions—you can probably automate it.

- If IT lacks sophistication, there’s untapped potential.

- If the default solution is to “hire more people,” automation should be next on your agenda.

Processes to automate first

Not every process is worth automating—but some are too obvious not to. The best starting points are those with high manual effort, measurable financial impact, and repeatable logic. Below are key end-to-end process areas and individual workflows that consistently deliver strong ROI across portfolio companies. Here are three example processes:

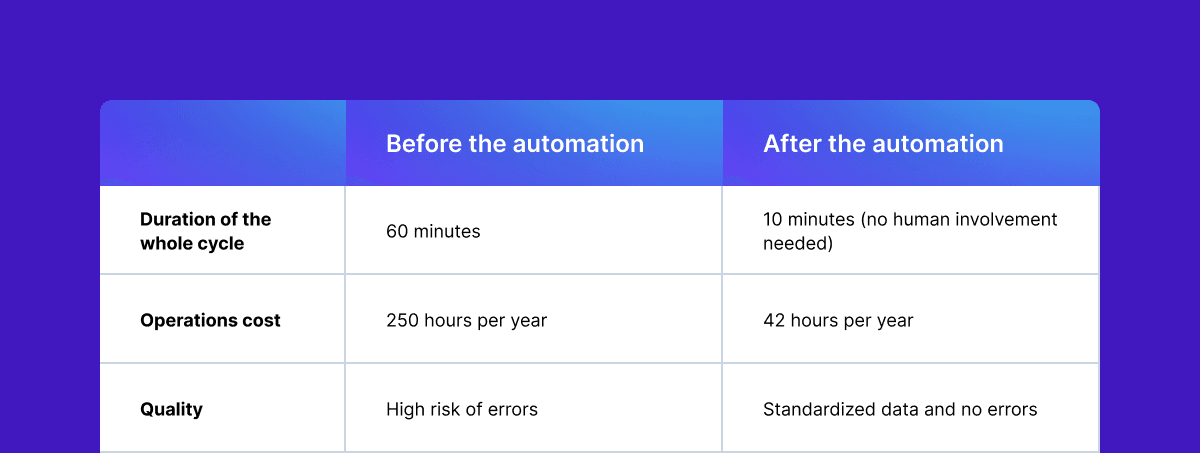

- Cashflow reporting. For finance teams managing daily reports from multiple bank accounts, automation delivers immediate ROI. An RPA bot retrieves bank statements from emails, consolidates data, recalculates exchange rates, and generates ready-to-send PDF reports—while updating ERP fields in real time. It reduced manual effort by 83%, saving around €5,000 per year in labor costs.

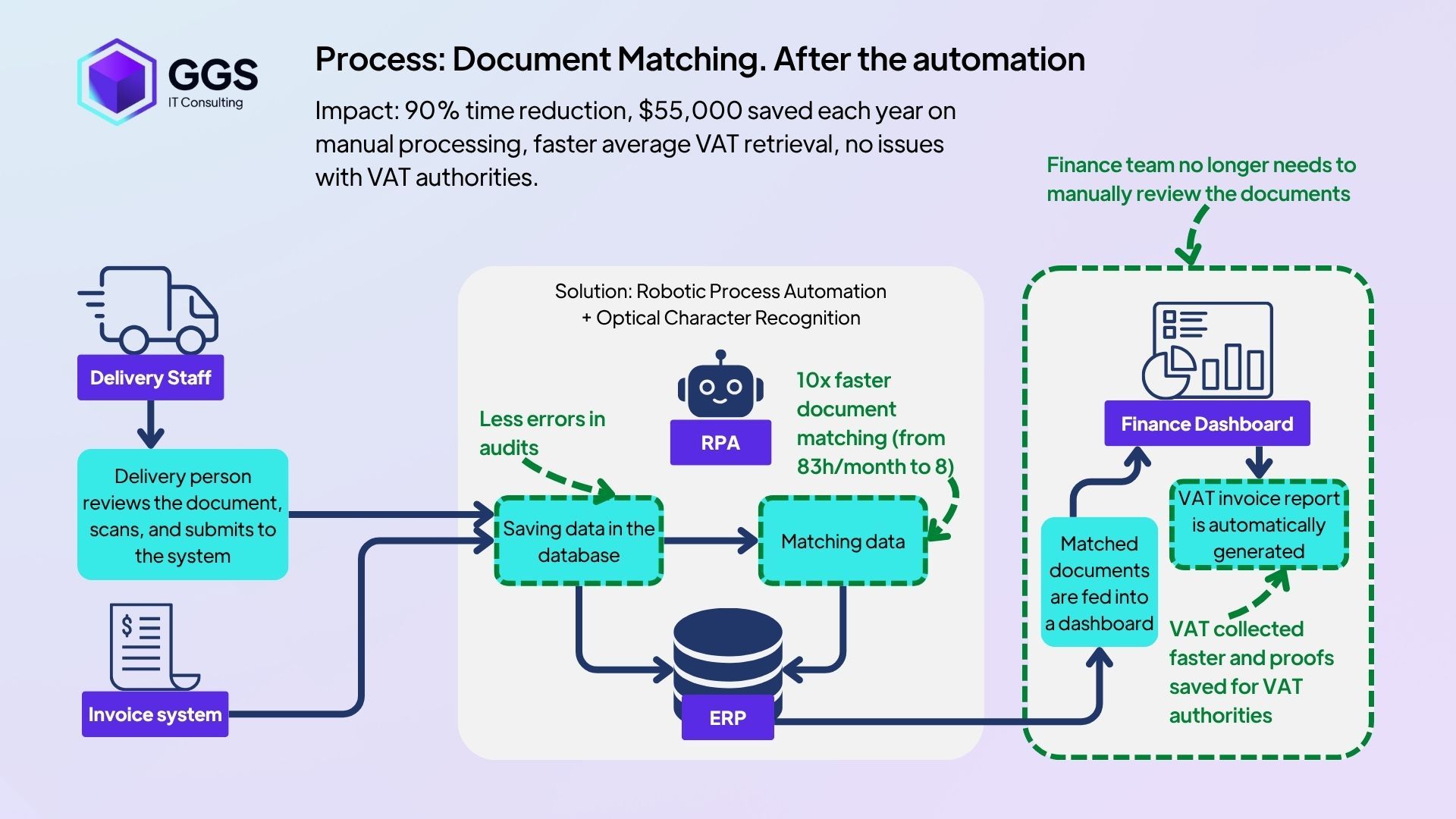

- Document matching. In manufacturing and logistics, Optical Character Recognition (OCR) and process automation streamline the linking of invoices with Proofs of Delivery (PODs). Accounting teams often manually search for PDFs, match them by delivery number, and attach them to invoices in the ERP system—a slow and error-prone process. With automation, one of our clients cut processing time from 5 minutes to 30 seconds per file, reducing monthly workload from 83 to 8 hours, and bringing error rates below 0.5%.

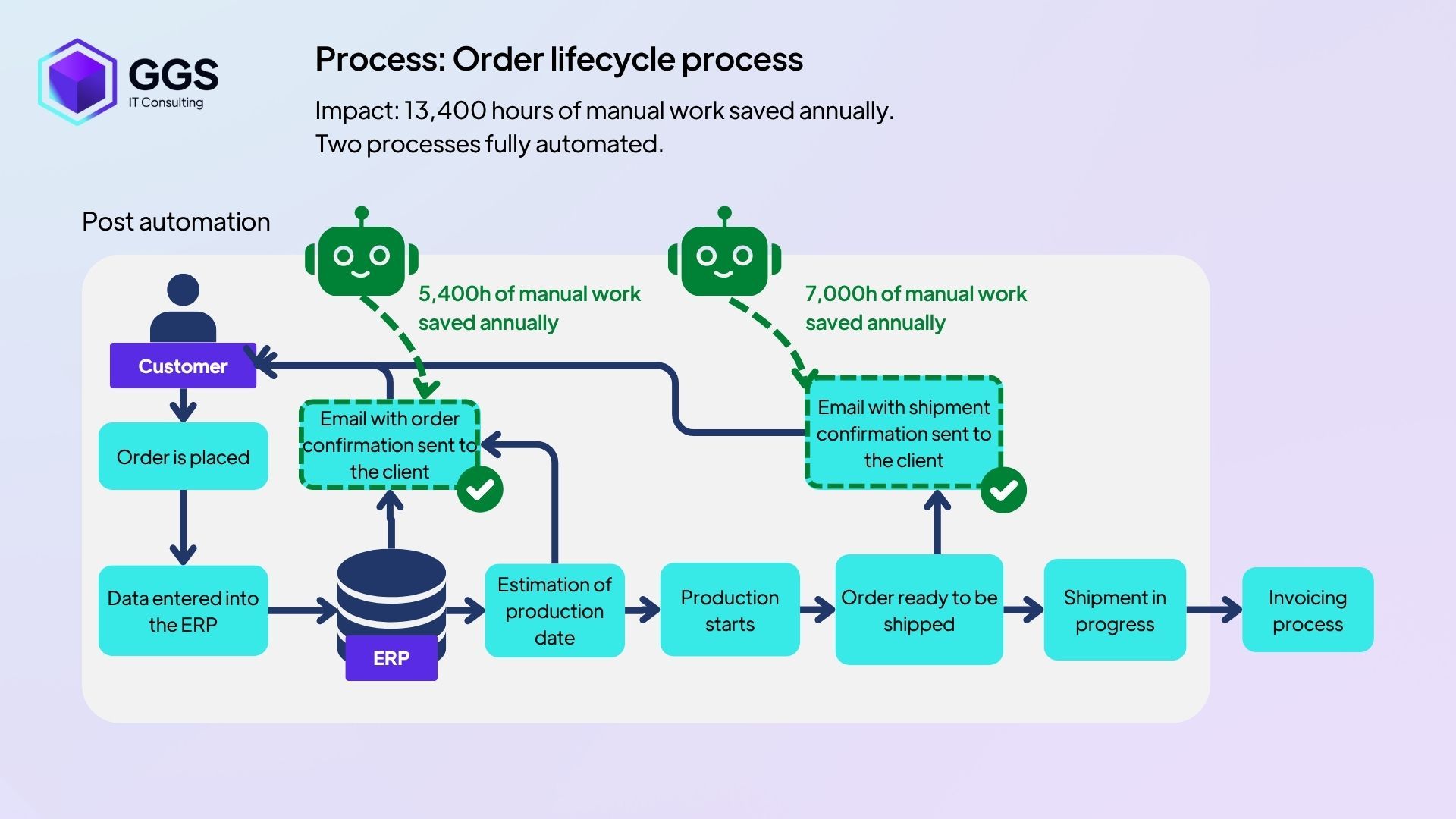

- Order lifecycle. For large manufacturing and logistics operations, handling unstructured orders manually can consume thousands of hours each year. One client relied on a 30-person team to process and validate orders, coordinate with production, and cross-check stock and customer terms—all in disconnected systems. By introducing an AI agent to read and structure incoming orders and an RPA robot to verify data and update the ERP automatically, the company achieved a 60–70% time reduction and cut customer service workload by 80%, improving both speed and accuracy of order processing.

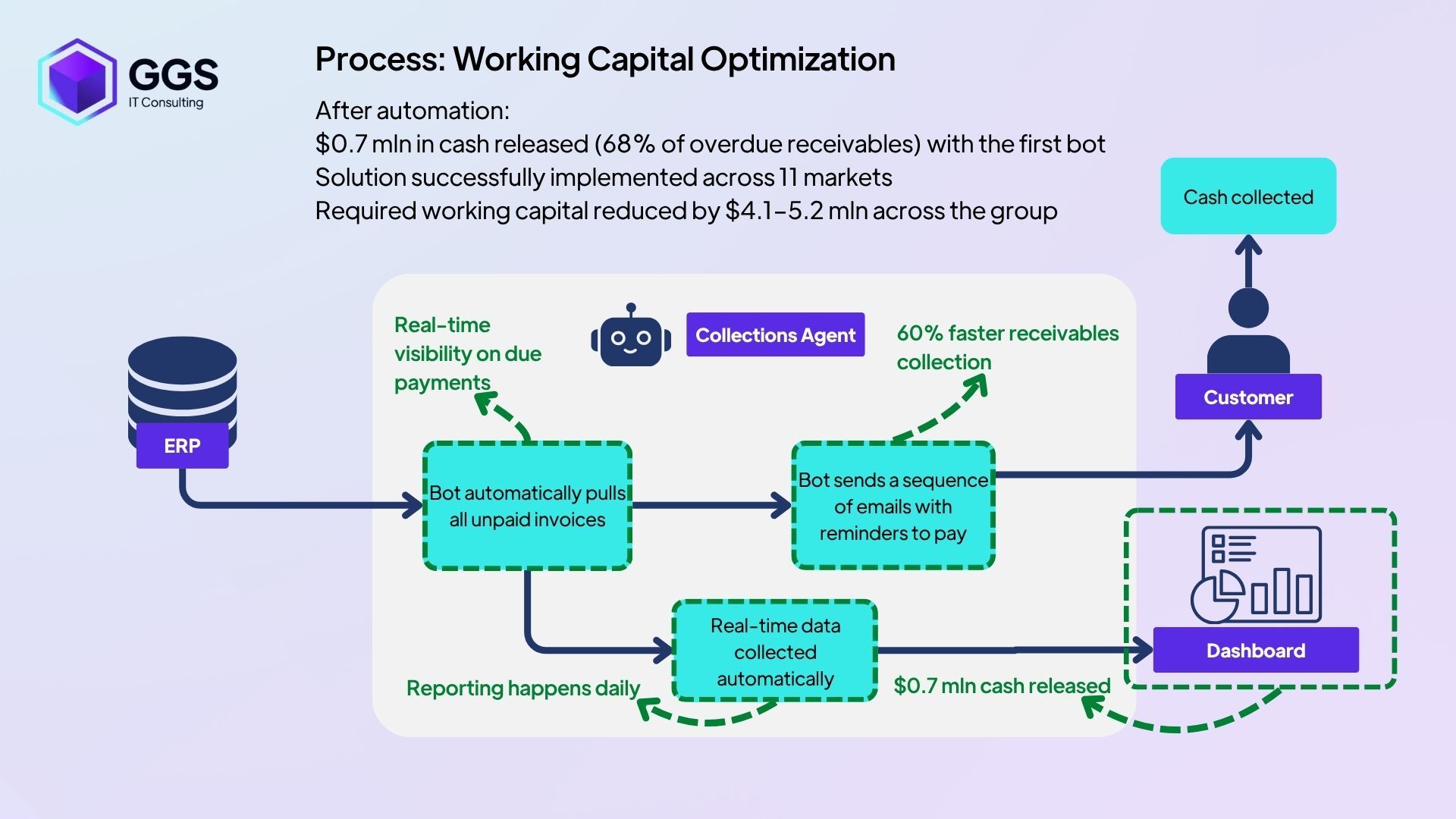

- Working Capital Optimization. Automating receivables collection unlocks frozen capital that can drive further investment and growth. A robot downloads overdue invoices from the ERP system and generates personalized reminders on behalf of the finance department. For our client, the results included $0.7 million in cash released in the first market, and within months, 11 markets adopted the solution, freeing an estimated $4.1–5.2 million in working capital across the group. The process shortened DSO, improved visibility into overdue payments, and reduced late receivables from 25 percent to below 8 percent—all with an ROI payback period of under three months.

Key takeaways

- Operational excellence is the new financial leverage. It compounds value across every portfolio company.

- Start with information. If you can’t measure it, you can’t improve it.

- Automate where it hurts most. Admin, Excel, and compliance workflows hide untapped ROI.

- Build capabilities, not dependencies. The goal isn’t to rely on consultants but to create lasting competence inside the portco.

- Execution beats diagnosis. A 30% EBITDA uplift comes not from another report, but from systems that actually work.

Ready to diagnose your operations and plan automation roadmap for the whole holding period? Let’s chat!